Blue Cross digital tools can help save time and money

February 15, 2022The ability to shop for health care services and procedures to find the best quality and convenience for the lowest cost has long been a missing piece in the overall health care consumer landscape.

Most people won’t buy anything without looking at how it compares to other options in terms of price or experience – except when it comes to health care. Due to the complex nature of the health care system, it is often hard to fully understand what you are getting and what you will have to pay out of pocket, until the bill arrives.

The main reason for this is that services and procedures can cost different amounts based on which provider you go to – even if they’re both in network. What you pay out of pocket can change according to that total cost. Then, real-time information about your specific plan’s cost-sharing requirements and how much you have already spent out of pocket need to be applied.

Giving patients and members the power to decide where they want to receive their care based on cost, convenience and other measures is much easier said than done, but Blue Cross and Blue Shield of Minnesota is working hard to make that a reality through a new, integrated provider search and price comparison tool.

A more informed and streamlined health care shopping experience is now possible. Try some of these tools today to start saving time and money.

Get a personalized estimate with the enhanced Care Cost Estimator

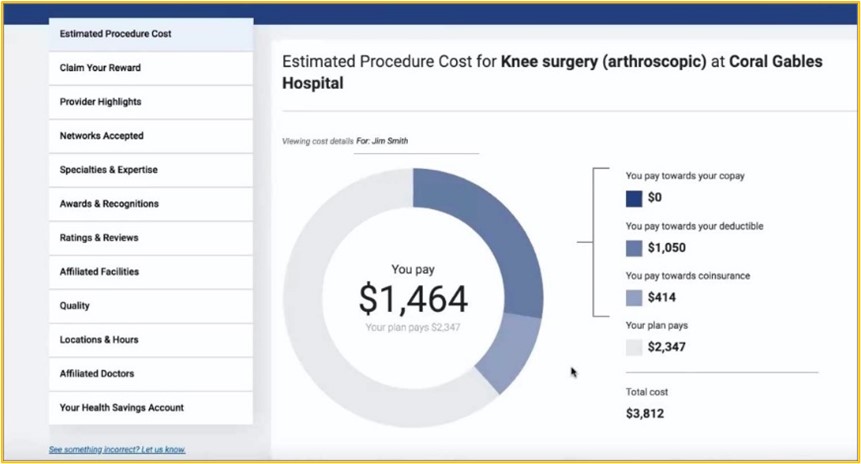

Many traditional tools for estimating health care costs simply provide a range of what the total cost for a service or procedure might be, without including detail about what portion a member or patient would have to pay. This has made shopping for health care less than optimal, as it is difficult for a member to understand what their own costs would be, based on their specific health plan details.

Personalized estimates require individualized data points for each member’s health plan information and real-time health care spending, including how much of an annual deductible has been met and what the coinsurance is based on the estimated total cost.

This information is combined to provide reliable insight into what the actual cost of a health care service for an individual consumer will be. The new cost estimator tool from Blue Cross does just that for members who get insurance through their employer or the individual marketplace (“commercial plans”).

“When consumers shop for any product or service, that drives competition, which leads to lower costs and better quality over time,” says Matt Hunt, chief experience officer at Blue Cross. “The enhancements we’ve made to our cost estimator have the potential to significantly improve the health care consumer experience and slow the rising cost of care. Our members can now find an accurate estimate for what they themselves will pay for more than 1,400 medical services and procedures.”

For a detailed summary of the enhanced Care Cost Estimator tool, see the video below.

Integration with ‘Find a Doctor’ gives members the full picture

Many Blue Cross members are familiar with the Find a Doctor tool, which helps identify in-network health care providers based on each individual’s specific health plan. This personalized experience is now enhanced with the integration of the Care Cost Estimator and an upgrade to the overall design. Now, commercial health plan members can compare prices among all their in-network providers, along with other criteria to choose the right provider for every care need. Watch the video below to learn more.

Does your service or procedure require a prior authorization? There’s a new tool for that, too.

As discussed in this blog post from Blue Cross chief medical officer, Dr. Mark Steffen, care management – including prior authorization – is important to ensure that our members are receiving the most appropriate care at the right time and place. This process helps to maximize the value of our members’ health care dollars and reduce the unnecessary and expensive care that often occurs.

One of the frustrations with prior authorizations for health plan members is the uncertainty about whether it is required for a desired service or procedure. Typically, members rely on their health care provider to inform them about the requirement and submit the necessary information for approval. Now, with a new tool from Blue Cross, both members and providers have easier access to this information.

Prior authorization requirements for a wide variety of services across all types of Blue Cross plans are included in the new Prior Authorization Lookup tool, along with details about any relevant medical policies or special instructions that may apply.

”Our prior authorization lookup tool now provides an efficient, self-service way to support providers and members in determining if a prior authorization is needed for a particular service,” explains Dr. Steffen. “It can be used at the point of care and not only improves the experience for our members and providers, but also helps to eliminate providers sending in prior authorizations for services that do not require one.”

Click here to access the online Prior Authorization Lookup tool from Blue Cross.