It's time to extend policies that keep premiums affordable

July 22, 2022Since the implementation of the Affordable Care Act (ACA) more than a decade ago, important progress has been made to reduce the uninsured rate. That positive momentum reflects a policy shift to help those buying insurance on their own, thus ensuring that everyone has access to affordable coverage.

Most individuals and families under 65 have private health insurance provided by an employer. With job-based insurance, the employer typically pays for a sizeable portion of the premium for each person enrolled. Your share – which can be seen as a deduction from your paycheck – varies based how much your employer pays and the specific benefit plan you select.

The Individual Market

For people who do not have the option of employer-based coverage − and are not eligible for either federal or state government health plans – options are available through the individual health plan market. Currently, about 3 percent of Minnesotans (163,000 people) have individual health insurance plans, including 107,000 Minnesotans who are covered by health plans offered through MNsure, our state-based Affordable Care Act (ACA) marketplace.

In the individual market, premiums vary depending on a number of factors, including geographic location, age and plan selection.

The biggest difference between employer-based coverage and individual health insurance? With no employer subsidies to offset the expense, individual plans require the enrollee to pay the full amount of the premium. Those buying on their own also pay for insurance after taxes. That’s why the ACA established tax credits to lower their costs – effectively treating this population equal to those with job-based insurance.

Financial assistance options

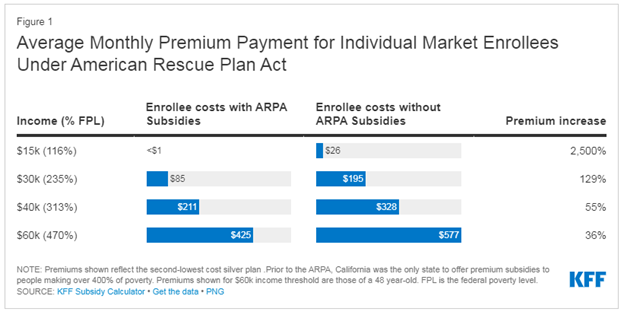

The American Rescue Plan Act (ARPA)—passed by Congress in March of 2021—was a comprehensive stimulus package that aimed to speed up the country's recovery from the effects of the pandemic. Included in this legislation were provisions that aimed to reduce premiums and make health care more affordable for those buying health insurance through the individual market.

Specifically, ARPA boosted individual marketplace credits for people earning under 400 percent of federal poverty level wages. For example, ARPA reduced average monthly costs by $45 for families of four with household incomes starting at approximately $41,000.” ARPA also limited the premiums for those enrolled earning more than that to 8.5 percent of their income. This was vital assistance for many Minnesotans paying 25 percent or more of their income in health insurance because of the differences with job-based insurance cited above. However, the ARPA designed these subsidies to be temporary. These are set to expire in October.

No subsidies? Premiums, uninsured rates to rise

The number of uninsured Americans has fallen in the past year and is approaching an all-time low. Minnesota continues to have one of the lowest uninsured rates in the country. Yet all of this progress is at risk of being rolled back if the ARPA subsidies expire.

According to data released by ASPE, with no ARPA subsidies, an estimated 3 million people would lose their health coverage, 8.9 million people would have their tax credits reduced, and 1.5 million would lose their subsidies entirely. Costs for coverage could more than double for some enrollees.

In order to keep the number of uninsured low and prevent premium rates from skyrocketing, we believe federal lawmakers should make the ARPA changes permanent and avoid a spike in insurance rates.

The public health emergency and Medicaid redeterminations

Counties and state agencies in Minnesota and throughout the country will soon begin reassessing the Medicaid population for the first time since the pandemic’s onset. This is the result of the suspension of that work to soften the impact of the pandemic’s impact. The result is that many individuals will need an alternative source of insurance with the individual market the best option for many. That factor is another reason why it is critical to given certainty to lower and moderate-income families, whose costs were reduced by 30 percent or more as noted above.

A state-based solution: reinsurance

Here in Minnesota, the recent extension of the state’s reinsurance program is another tool that’s working to stabilize the individual health insurance market and help lower premiums across the state. On average, reinsurance has reduced premiums by 20 percent for Minnesotans buying on their own.

Reinsurance is a program that offsets the cost of unusually expensive claims. The state and federal dollars that the health plans receive are used to pay medical bills for the care that people receive. This program is invisible to consumers, so they do not experience any disruption. Reinsurance is critical to allow insurance companies to stay in the market and keep rates stable.

An impact on costs for all markets

While a lot of the conversation about premium subsidies or reinsurance is centered around the individual market, these policies do affect everyone. If underlying health care costs are kept down, ultimately costs will shift and be felt by other members. That's why Blue Cross is working hard to help control health care costs and ensure access to timely, affordable, and high-quality health care for our members and our communities.